As a result of social distancing and lockdowns, people are more open to digital offerings as they are getting accustomed to more online interactions. This change of behavior has unlocked a lot of new opportunities and possibilities to market insurance online.

In this post, we’ll take a look at some of the best digital marketing ideas for insurance with real examples from the industry. Let’s get to it!

Content Marketing

What we mean by “content” is not only limited to written materials like blog posts or newsletters. A marketer should also consider producing other forms of content like social media posts, videos, podcasts, infographics, case studies, or the likes.

Content is King

Bill Gates

And the key is to use your content to answer your prospective customer’s questions along the buyer’s journey.

For example, early in the awareness stage when a prospect has just realized the need for buying insurance, short-form content that answers their questions directly will do the job well.

Examples may include:

- Explainer videos

- Infographics

- Short blog posts (e.g. checklists, guides, or how-tos)

- FAQs

And towards the closing, BOFU (bottom-of-funnel) content will work well to facilitate the conversion. Examples may include:

- Customer interviews

- Testimonials

- Service demo/walkthrough

- Client case studies

- Discount offer

Yes, it can be intimidating to produce different types of content consistently. But the good news is, you can repurpose one type of content to another.

ALSO READ:

For example, blog posts can be transferred into social media posts, email newsletters, infographics, podcasts, videos and so on. So for one piece of content, you can literally spin it off to a couple of other forms to reach different audiences in different channels.

To learn more about what kind of content to produce at the different stages along the buyer’s journey for insurance, you can read our post on Customer Journey Mapping: Purchasing Health Insurance Online

SEO Marketing

SEO is a huge topic and I just want to be specific with the insurance context here. After all, it’s all about getting organic traffic from search engines. I will zoom out our discussion and talk about Local SEO and Organic SEO in a broader sense for your insurance marketing plan.

Local SEO – This strategy aims to provide quick and direct offerings to the customers.

With local searches, people usually have the intent to shop for a product or service close to them. They will type in the name or the type of product, service, or business and either the name of their city or the term “near me”.

Mobile queries that contain “insurance near me” have grown by over 100% in the past two years. More than ever, insurance shoppers are placing local searches and researching agents in their area.

Google

To learn more about how to improve your local SEO, you can check out this article: Top 10 Ways to Improve Your Local SEO Right Now by Wordstream.

Organic SEO – is all about focusing on producing relevant and authoritative content that is usually not an immediate need but worth spending their time for the research.

When someone types an organic search into Google for this intent, they are searching for content that answers their questions. The point is to show up in top position of SERPs by making your website favorable and crawlable by the bots search engines use.

During the course of the buyer’s journey for insurance products, your prospects will have different questions at different stages, with different insurance products.

Don’t worry, we’ve had you covered. We have list out the most common insurance topics you can include in your SEO marketing strategy to drive more traffic to your website.

PPC Marketing

While SEO or organically reach may take time to build up, you can use pay-per-click (PPC) ads to push your offering to the top of relevant SERPs. Likewise, you can also run ads on social media like Facebook, Twitter, LinkedIn, YouTube, Instagram, or any other platform.

PPC ads allow you to target specific audiences according to their demographics such as location, age, gender, or income range. A PPC marketing campaign can speed up your conversions over a short period of time.

Here are some key stats about PPC for the insurance industry in general:

- Insurance keywords are among the most expensive ones and some can cost up to $54 or more per click.

- The average conversion rate for an insurance search ad is 5.10%.

- The average conversion rate for an insurance display network ad, it’s 1.19%.

You may use these stats as a reference to plan your marketing budget or use them as key metrics to measure your ad’s performance accordingly.

Social Media Marketing

Social media is an essential part of any online marketing strategy – no question about it. But it might get a bit intimidating with so many platforms to start with, be it Facebook, Twitter, Linkedin, Instagram, Tiktok, or YouTube.

A simple approach is to start with 2-3 social platforms that your target customers are currently using.

A little note on Facebook here. They have made their organic reach to less than 5% of your followers. That means unless you use paid ads to promote your content, for 1000 people who liked your page, less than 50 of them will actually see your posts in their news feed.

But the flip side is that their paid ads allow you to set your target by location, demographics, or income range and so on to make your offerings more relevant to a specific group of persona.

Also read:

Personalized Email Marketing

80% of consumers saying they are more likely to make a purchase when brands offer personalized experiences.

Email marketing is still one of the most effective online channels for reaching your prospects and customers. And to take it a step further, insurance marketers should take personalized email more seriously.

Personalized emails are sent to the recipients based on data collected about their personal particulars, preferences, or behavior. This can ensure relevant offers are provided at the right time, and to the right person.

To learn more on how to put it into practice, read our post:

Asking for Review

Nearly nine out of ten consumers read reviews before making a purchase.

Oberlo

Positive feedbacks, reviews or testimonial is essential for any business in the digital landscape. It is even more important when it comes to insurance – an industry where its customers demand more trust from the providers.

To start, dedicate a section on your website to display these reviews. And make it simple and easy for anyone in your organization to ask customers to write their reviews. This can be done by putting up a simple form in your website.

You could also encourage people to give your business review on social media. As people loved to be engaged with on social. You can reach out to individuals proactively by direct messaging to asking for a review.

Customer Referral Program

Simple as it may seem. But the challenge for a referral program in the insurance industry is the regulations. Many states don’t allow you to provide cash.

But it does not mean there’s no way to get around it. For example, you can send a $5 gift card for every quotation request from a referee, and even a $25 gift card for each person who buys a policy.

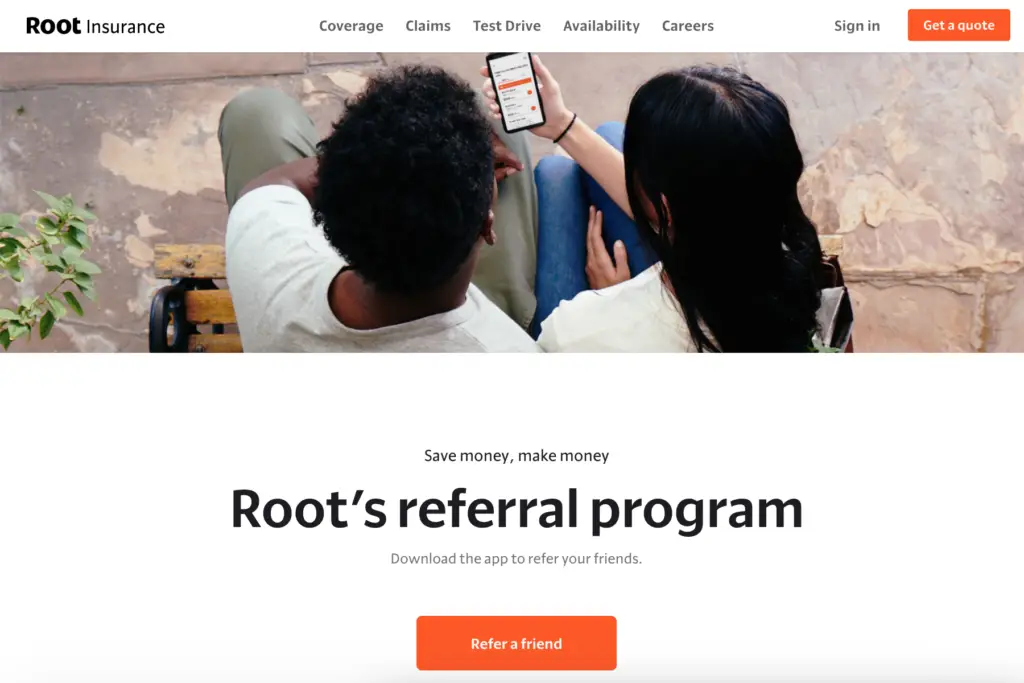

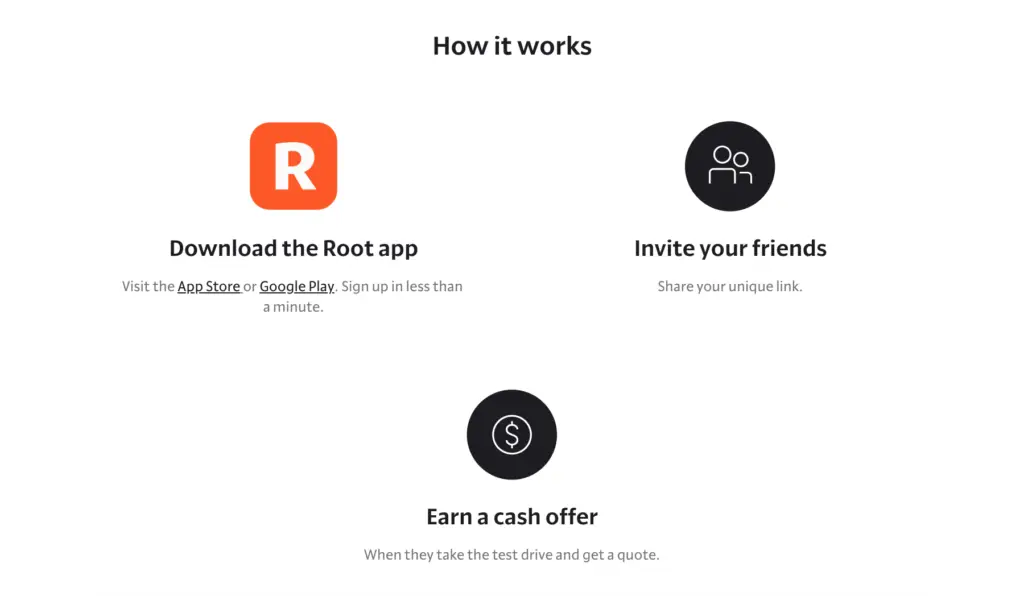

Root Insurance – a usage-based car insurance carrier, made it simple and easy for people to refer a friend and earn a “cash offer” in form of a gift card, by crediting to a PayPal account or even a bank transfer – all done with a mobile app.

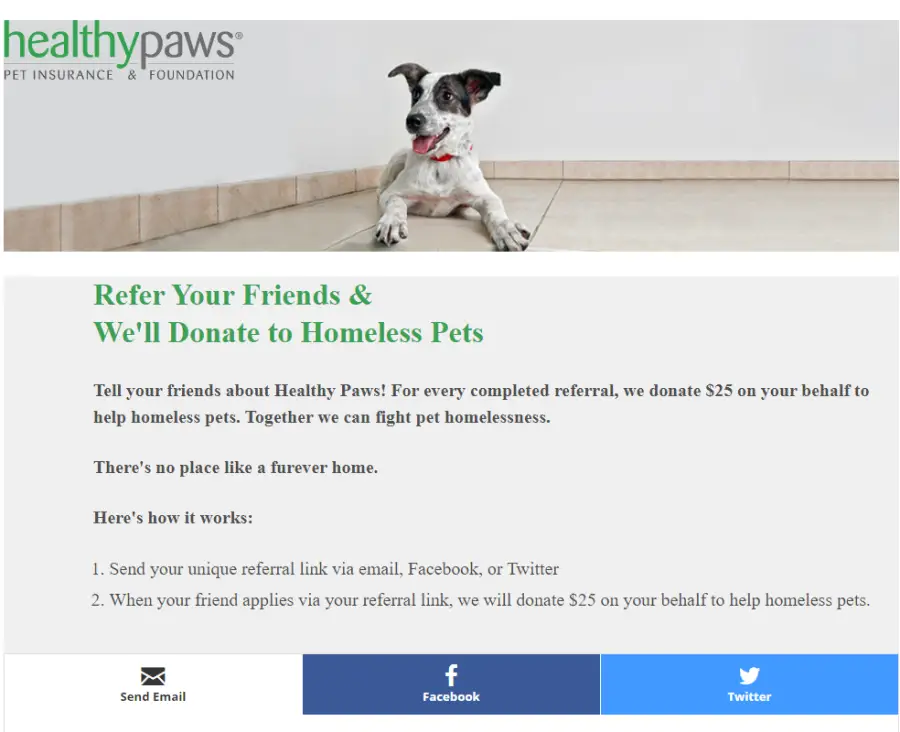

Healthy Paws Pet Insurance & Foundation – has an online referral program attached to a good cause and shareable links to social media as well as email. For every successful sale, they would donate $25 on behalf of the referrer to combat pet homelessness. Anyone can refer a friend on this page via email, Facebook or Twitter.

Customer Loyalty Program

It may cost as many as 10 times more to acquire a new customer than it does to keep an existing one. It makes every sense to make your existing customer happy and loyal to your brand.

Insurance is a low-touch industry and carriers may only contact their customers once a year before their policy renewal. However, technology, mobile devices and wearables have made it much easier for insurers to engage with their customers with meaningful touchpoints.

Take Vitality as an example, it is an insurance loyalty program with 10 million members across 22 markets, developed by a South African company called Discovery Limited.

Unlike many other loyalty programs that work with punch cards and stickers, Vitality has a main focus on building and maintain good health for its users.

They have created a rich reward program that incentivizes a healthy lifestyle and is based on behavioral economics. Examples may include having a medical checkup or taking a certain number of steps in a month.

Here are some of the carriers around the world that have implemented Vitality into their marketing strategy: Manulife (Canada), Generali (Europe), AIA (in South-East Asia and Australia), and Sumitomo (Japan).

Affiliate Marketing Program

In the simplest form, affiliate marketing is where you pay a commission to anyone who refers a client to you. We look at it as another online distribution channel to get your product more exposure as far as the internet can reach.

The amount of commission you have to pay will depend on the business line and the nature of the referral. Insurers usually pay $5-$10 for a qualified lead right upfront. And the commission payout for a successful application may start anywhere between 8%-50%.

Most of the big players like Allstate and Liberty Mutual already have their affiliate program in place. A good way to start is to become a merchant or advertisers on affiliate networks like Commission Junction, Share-A-Sale or FlexOffers.

And through these platforms, not only can you have access to bloggers or publishers who are willing to promote your insurance products, but you will also have all the logistics and tracking taken care of.

Most affiliate networks will charge a setup fee ranging from about $500 to $2,000.

Business Partnership

Business partnership is nothing new to insurers. Distribution channels like brokers or banks (also know as bancassurance) are typical business partnerships in a non-digital world. And in the digital landscape, it can scale up your business like putting wings on your back.

Today’s market is digital, customer-driven, and ecosystem/partnership enabled. So carriers are challenged to put together a winning team to create growth and make a profit.

PropertyCasualty360

So what kind of “team” should a carrier put together? Here are some real examples you can get ideas from:

Next Insurance – an online insurance provider for small businesses based in California, has recently formed a partnership with Amazon Business. Over 5 million of Amazon’s Business Prime members can have access to small-business insurance including general liability, professional liability, workers’ compensation and more, offered by Next Insurance.

Nationwide – have launched their Partnership Program for prospective partners (from real estate, automotive, pet care, retail, business services and more) to distribute its insurance products. It provides an integrated “front door” where companies can quickly enable a partnership with Nationwide.

Chubb – is one of the largest P&C insurance operators has entered into a partnership with Grab, an on-demand transportation and FinTech platform in Southeast Asia. product coverage will include accident, hospitalization and critical illness insurance coverage to Grab’s 2.6 million driver-partners and will be accessible through the Grab driver app.

Final Note

Putting all of these marketing ideas together will certainly demand a lot of time and effort. Some initiative will take longer than the other to achieve. Any wise insurance marketer should prioritize their marketing goals and develop a marketing plan that works best for their brand.

The bottom line is to go for the best ROI within your marketing budget and your time frame. And at times, it may even justify to orchestrate your marketing efforts by outsourcing. Good luck!