Over the last five years, the pet insurance market has grown on an average of 20% annually. With premium volumes jumping up to $1.6 billion in 2019 from $660 million in 2014, it shows no signs of slowing down.

You will be leaving money on the table if you do not take advantage of promoting pet insurance. Below are 30 facts and stats about pet insurance worth sharing with your clientele as you plan your marketing strategy to market pet insurance.

About the Pet Insurance Market

1. An estimated 67% of all households in the United States own at least one pet.

A whopping 85 million households in the United States have at least one dog or cat. As more people bring pets into their homes, pet insurance may be a helpful way to take care of their animals without breaking the bank.

2. Households in the U.S. have just under 184 million pet dogs and cats.

Boasting numbers like these, it’s not hard to see that household pets are extremely popular in the U.S. Talking to pet owners about the benefits of pet insurance may help you expand your insurance products.

3. According to the American Pet Products Association, 50% of the U.S. population owns a dog, and 34% own a cat.

A large segment of the population owns a household pet. Still, with so few carrying pet insurance, that might present an excellent opportunity to expand pet insurance products in your firm.

4. In the U.S., an estimated 63.4 million households own a dog, and 42.7 million households have a cat.

The sheer number of dogs and cats in the household shows how popular they are. There are many opportunities to promote pet insurance products.

5. States with the largest proportion of pet insurance policies include California (19.4%), New York (9.1%), Florida (6.2%), New Jersey (5.4%), and Texas (5.1%).

Combined, these five states represent over 45% of pet insurance policies issued in the United States. If you currently sell insurance in any one of these states, you might consider adding pet insurance to your product mix.

6. An estimated 80% of owners consider their pets to be family members.

Owners want the best for their pets. Whether it is gourmet food or a fancy place to sleep, pet owners treat their animals like they are part of the family. Yet when it comes to veterinary care, pet owners can find their decisions strapped to cost. If the cost is too great, they may be forced to skip veterinary care—that is, if they don’t have pet insurance.

7. Millennials and Generation X represent over two-thirds of pet owners in the U.S.

Household pets remain popular with the younger generations. With their increased focus on health and wellness, they may lean more toward pet insurance if they place a high value on regular veterinarian visits and vaccinations.

8. Over the past five years, pet insurance has grown in an average of 22.1% per year.

The immense popularity of pet insurance is evident with its healthy growth rate. As pet owners grow tired of costly vet bills, this growth is expected to continue.

9. The global pet insurance market is expected to surpass $10 billion by 2025.

As pet ownership rises, so will the need for pet insurance. As more pets are in the home, owners need to find ways to keep their costs down, yet ensure their pet gets the medical treatment they need.

About Pet Insurance Coverage

10. It is estimated that just over 1.6% of household dogs and cats are covered under a pet insurance policy.

Pet insurance meets the needs of an underserved market. Pet owners may not understand how pet insurance works. But as they look for ways to get quality care at an affordable price, expect that more pet owners will opt for insurance.

11. Dogs make up approximately 83% of insured pets in the United States. Cats make up the remaining 17% of insured pets.

Dog owners are more open to purchasing pet insurance than cat owners. Veterinary care for a dog usually costs more than a cat. Focusing your energy toward promoting pet insurance with dog owners is a strategic way to grow your business.

12. By the end of 2019, 2.82 million pets were covered under pet insurance.

Compared to the total number of pet dogs and cats in the U.S., only 1.5% are covered by pet insurance. This poses an incredible growth opportunity for insurance marketers as pet owners seek ways to get quality care for their pets and an affordable price.

13. Pet owners don’t have to worry if their veterinarian takes their insurance; the policy reimburses the owner for covered costs.

This is good news for pet owners. Finding a veterinarian that the owner trusts is a big deal. This can be a great selling point with a pet owner if they think they have to change to a vet that takes their insurance.

14. Pet insurance policies cover no pre-existing conditions.

This is a crucial point for pet owners to understand. When their dog or cat is young, buying a pet insurance policy may help ensure that future health problems are covered. If the owner waits until the dog or cat is older before investing in pet insurance, they run the risk that their condition may not be covered.

| More: Insurance Facts and Stats |

About Pet Medical Expenses

15. A pet owner faces a vet bill exceeding $1,000 every 6 seconds.

That is an astonishing figure. Families should not have to endure financial hardship to pay for their dog or cat’s care, but they often do. But, when pet insurance covers the vet bill, the family’s finances stay stable.

16. Routine veterinarian costs for dogs can average around $250, whereas surgical visits can cost over $600.

It doesn’t take a major medical emergency to wreak havoc on the family budget. Unexpected procedures and exams can quickly cut into a family’s savings. Even though pet insurance requires monthly premiums to be paid, the pet owner knows about and plans for it.

17. An unplanned visit to the veterinarian for your dog or cat can cost anywhere from $800 to $1,500 on average.

Taking a sick or injured household pet to the veterinarian can wreak havoc on the family budget. Even routine costs, like checkups and vaccines, add up quickly. Out-of-pocket costs can dwarf what a pet owner would pay for the average pet insurance policy.

18. A pet receives emergency medical care every 2 ½ seconds in the U.S.

It’s a scary thought, but dogs and cats get hurt. They eat things they shouldn’t, and they can catch colds. When an unexpected medical emergency happens, pet insurance helps get them the medical help they need to recover.

19. The average household spends $1,386 for veterinary care for their dog each year.

Many households live on a tight budget, so buying pet insurance may seem like an unnecessary expense. But when you compare the cost of insurance to the average amount that a household spends each year on vet services, pet insurance is clearly the economical choice.

20. Skin allergies are the most common health issue that dogs face. Estimated treatment costs can run you $5,000 over a dog’s lifetime.

Dogs have allergies, just like people. This is a common health problem that can start at any time. Pet owners may choose to invest in pet insurance to help defray costly vet visits, skin treatment, and medication.

21. An estimated 1 in 3 dogs will get cancer over their lifetime, with cancer treatment costing between $10,000 and $20,000.

Dogs are a part of the family. Having pet insurance in place gives the owner the peace of mind to know they can afford treatment if their dog is seriously ill. The earlier the owner covers their pet, the better.

22. Cost restricts recommended veterinarian care 45% of the time.

One of the hardest things a pet owner may face is choosing between their pet’s health and money. When the treatment is too costly, pet owners may forgo care because they cannot afford it. A pet insurance policy gives pet owners the comfort of knowing their beloved pet is being taken care of.

About Buying Pet Insurance

23. The best time to buy pet insurance is when pets are young.

Pet insurance policies won’t cover pre-existing conditions. When a pet is younger, there is less chance it will be suffering from illness or disease. So if they develop these conditions as they age, their treatment may be covered by their pet insurance policy.

While it may not seem cost-effective to buy insurance when a pet is young, the cost is well worth it if they suffer from a severe health condition in the future.

24. The average age of insurance enrollment for a pet is 3 ½ years old.

It may take a few years for a pet owner to decide to cover their dog or cat with pet insurance. As they experience the high cost of vet care, pet insurance may be an affordable option to get their pet the care they need.

25. According to the North American Pet Health Association (NAPHA), the average cost of pet insurance premiums for a year is $585.40 for dogs and $349.94 for cats.

Additionally, the estimated monthly premiums are $48.78 for dogs and $29.16 for cats. Compared to the average cost of unplanned vet visits, it’s hard not to make an argument for pet insurance. You know how much customers need to pay each month toward the premiums. As long as the expenses are covered, there are no surprises with pet insurance.

26. Pet insurance premiums vary based on your dog or cat’s breed, age, and where you live.

If you sell pet insurance products, specializing in specific markets may help grow your business. Pet owners of younger animals or special breeds may be more likely to buy pet insurance to help control future health costs.

27. Certain breeds have health issues, such as German Shepherds, Cocker Spaniels, and Bulldogs.

Many dog owners invest several hundred dollars for a specific breed of dog. But these specialized breeds may be known for their health issues. As such, a pet owner may be willing to invest in pet insurance to help defray future care costs, especially when their dog is young.

28. Pet accident and illness insurance coverage accounted for over $5.4 billion in 2018.

Pet insurance coverage ranges from accident, accident and illness, and wellness. Accident and illness coverage is by far the most popular pet insurance policy sold.

About Pet Insurance Claim

29. Pet insurance claims aren’t only for accidents or major illnesses; the most common claims submitted are for ear infections, diarrhea, and vomiting.

Pet insurance is not just for severe accidents and diseases. Owners can submit claims for any covered expense, regardless of how serious it is. If a dog or cat catches a cold or gets an ear infection, you can get reimbursed for what you’ve paid if the expense is covered. For a family on a tight budget, this may be a welcome feature.

30. 50% of policyholders file a claim each year.

Dog and cat owners who invest in pet insurance use it. Whether it is for emergencies or routine care, the high percentage of claims filed every year shows pet insurance premiums do not go to waste.

Conclusion

As pet ownership continues to rise in the U.S., so will the demand for pet insurance.

Families are looking for budget-friendly ways to get good care for their pets. They don’t want to be put in the position where their family pet’s care is stifled by their inability to pay for costly vet bills. Hopefully, with these 30 facts and stats, you can promote pet insurance as an affordable way to get vet services for your prospective clients.

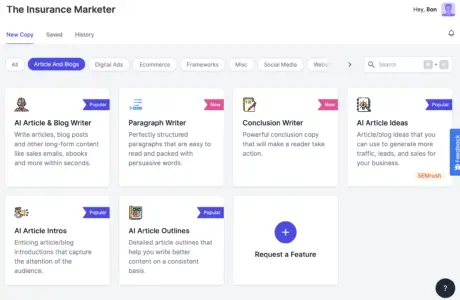

If you are an insurance marketer, insurance agent, or anyone who is looking to promote insurance online effectively, check out our recommended resources page for FREE tools you can use to supercharge your marketing game!