Insurance is a kind of product that does not provide immediate benefit or enjoyment right after the purchase. And people are less likely to get the same excitement by completing an insurance application in the same way they unbox the latest iPhone or apple watch. This makes marketing insurance, especially online a bit different.

With the pandemic and recent lockdowns, people are spending more time online and are also buying more. Last year, Millennials made 60% of their purchases online. As we all know Millennials are now the largest segment of buyers, how should we market insurance to them online?

As of 2020, millennials (born between 1981 and 1996), are the demographic of adults in their 20s to late 30s. In the US, there are 83.1 million Millennials (make up nearly a quarter of the population) and they are also the largest segment of the workforce.

Linkedin Learning – Marketing to Millenials

Join this online course from Chelsea Krost – a Pioneer in influencer Marketing – and a millennial herself, on Linkedin Learning.

Chelsea offers specific tactics that you can use to optimize your organization’s digital and social presence, and shares strategies for upping your content marketing efforts to inspire and engage consumers. (Start your 30-day free trial with LinkedIn Learning here.)

Here are eight tips marketers need to consider when marketing insurance to Millenials online:

1. Be authentic and talk like a human

A whopping 90% of millennials say authenticity is important when choosing brands they would buy from. They want brands that behave like a real person and speak to them directly.

However, insurance has a legacy of being too complicated for an ordinary consumer to understand. Oftentimes, it is full of jarons and has terms and conditions that are not easy to read.

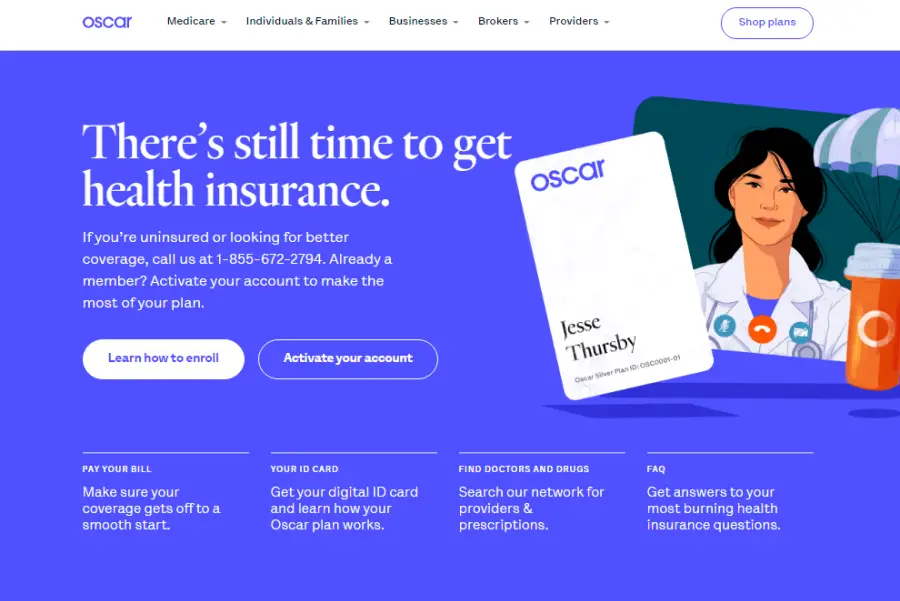

Oscar, a New-York based health insurer has set out to change that perception. Their tagline “Hi, We’re Oscar” for example, immediately communicates the company’s simple and friendly character.

Unlike traditional providers, they use an approachable, conversational tone to communicate their offering, just like what you would usually do with your friend. The brand is often referred to as “millennial-friendly”.

By being authentic – friendly, right to the point and even a little bit humorous in your communications – you will stand a better chance to be noticed by millenials among big players who all sound the same.

2. Support a social cause that align with their values

Millennials are very conscious about how their purchases may impact the well-being of the world. They look for the true identity within a brand. They are huge supporters of brands that try to make a positive impact.

According to Huffington Post, 61% of millennials are worried about the state of the world and feel personally responsible to make a difference.

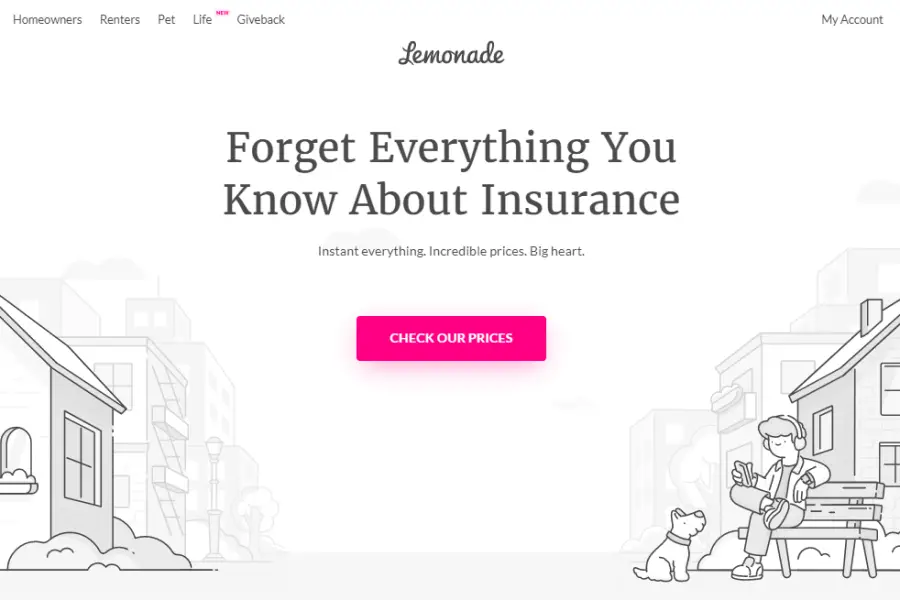

Lemonade (LMND), a mobile-based insurtech company, has just made the headline with one of the most successful initial public offering debut in U.S. in July 2020, offers renter/homeowner insurance online with competitive pricing that appeals to Millennials.

The company donates the unclaimed monies to the charity or cause selected by their policyholders through a program the Company calls the “Giveback”.

Millennials do want to align themselves with organizations doing good in the world. They vote with their purchasing power to support companies that have similar values.

| More: Insurance Facts and Stats |

3. Show them how to save more and spend less with your product

Ironically, with student loans and the impact of the financial crisis, millenials are earning lower average income compared to their parents. Therefore, they are eager to find good deals and spend wisely.

With this in mind, marketers have a higher chance to appeal to millennials by showing them how to save more and spend less with your product.

GEICO, the second-largest auto insurer in the US, is known for its creativity in its ads. Apart from offering relatively low prices, GEICO also emphasizes “savings” versus “service” among their ads.

Their famous slogan, “Fifteen minutes could save you 15% or more on car insurance,” has become a benchmark for auto insurance.

4. Be mobile-first across your online presence

Millennials spend more time on their smartphones than any other age group.

New startups usually understand this well as they are millennial themselves. But when working with a traditional insurer, marketers need to be aware that the website or even all your newsletters should be mobile optimized for shorter loading speed and better user experience. Otherwise, they will just go away.

In fact, Google prioritizes mobile page loading speed as a key metric when determining your website’s search ranking. Being on number one on a SERP (Search Engine Result Page) may not always guarantee a sale, but it will certainly reward you with a good amount of traffic on the same page.

5. Engage with them on social media

According to Forbes, 62% of Millennials say that if a brand engages with them on social media, they are more likely to become a loyal customer. For millennials, it’s absolutely important that they feel like they’re a part of something by engaging with the brands they like.

Social media is built for interaction to take place. Examples may include seeking their opinions on a product feature with a short poll, inviting them for a focus group, or asking them to recommend a social cause. These are some of the common ways to get engagement from your millennial customers.

ALSO READ:

On top of that, it is not uncommon for brands to use social media as a customer service channel. And likewise, it is another way to engage with and even delight your customer.

When they ask questions, it’s important to respond quickly and accurately. Not only does this help improve customer relationships, but it is also a valid proof that the brand does listen to their customers.

6. Don’t forget email marketing

Does email marketing still work after we are so used to social media and instant messaging apps?

The answer is yes! Emails are still one of the most effective marketing tools to date. Surprisingly, millennials are still obsessed with email. They check their email first thing in the morning while they are still in bed. And they do check email when they get into the office.

Email allows marketers to send personalized messages to engage their customer at scale. Do not limit your communication with customers with computer-generated policy statements or premium notice with no signature. I will illustrate this with the example below.

ALSO READ:

7. Provide personalized offers

Insurers is lucky enough to have more data of their customers than any other industries. The question is, how to turn the data into personalized messages that converts?

Here’s an idea to create an upsell opportunty from an existing customer base on the data you have. First, get the averaged coverage (of life insurance for example) in a specific age group. It is obvious that it would be Millennials.

ALSO READ:

Then look into your CRM to sort out the customers with coverage below the average coverage amount you have just worked out.

On the anniversary, send email to these “under-insured” customers and entail a short reminder to them they happen to have less coverage than their peers.

Then you can share with them how important it is to have enough coverage as and it make sense to review their coverage year after year.

8. Use referral program

At any time of the day, Millennials are sharing, forwarding, tagging, tweeting and retweeting. And the good news is, 90% of millennials do look for recommendations from their friends before buying.

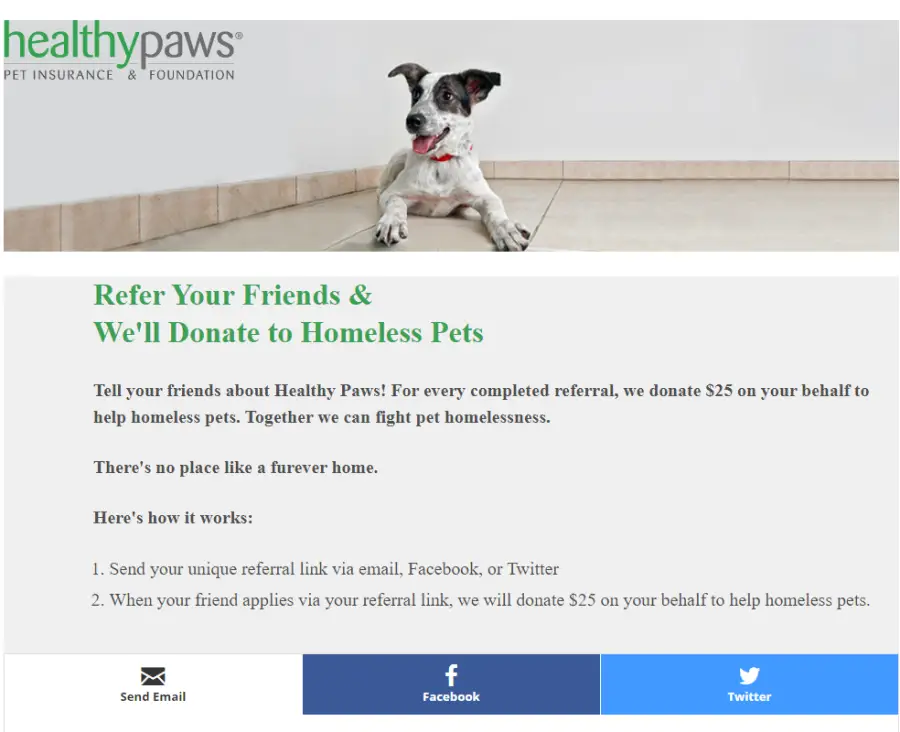

Healthy Paws Pet Insurance & Foundation has nailed it with a referral program consisting of three key elements that work for Millennials – an authentic message, a good cause, and shareable links to social media as well as email.

The message is simple and friendly. For every successful sale, they would donate $25 on behalf of the referrer to combat pet homelessness. This is a social cause that anyone can refer a friend on this page via email, Facebook or Twitter.

Conclusion

If there’s one thing that stays the same no matter if you are marketing online or offline, it’s that the insurance business is all about building and maintaining solid relationships and providing value to policyholders.

Whether you are working for a carrier, a captive insurance agency or an independent insurance broker, I hope these eight ideas can inspire you with some new approach when targeting millennials. By understanding their values, beliefs, habits and challenges, marketers stand a better chance to get their attention.